Best Semiconductor Stocks in India

Share With Friends

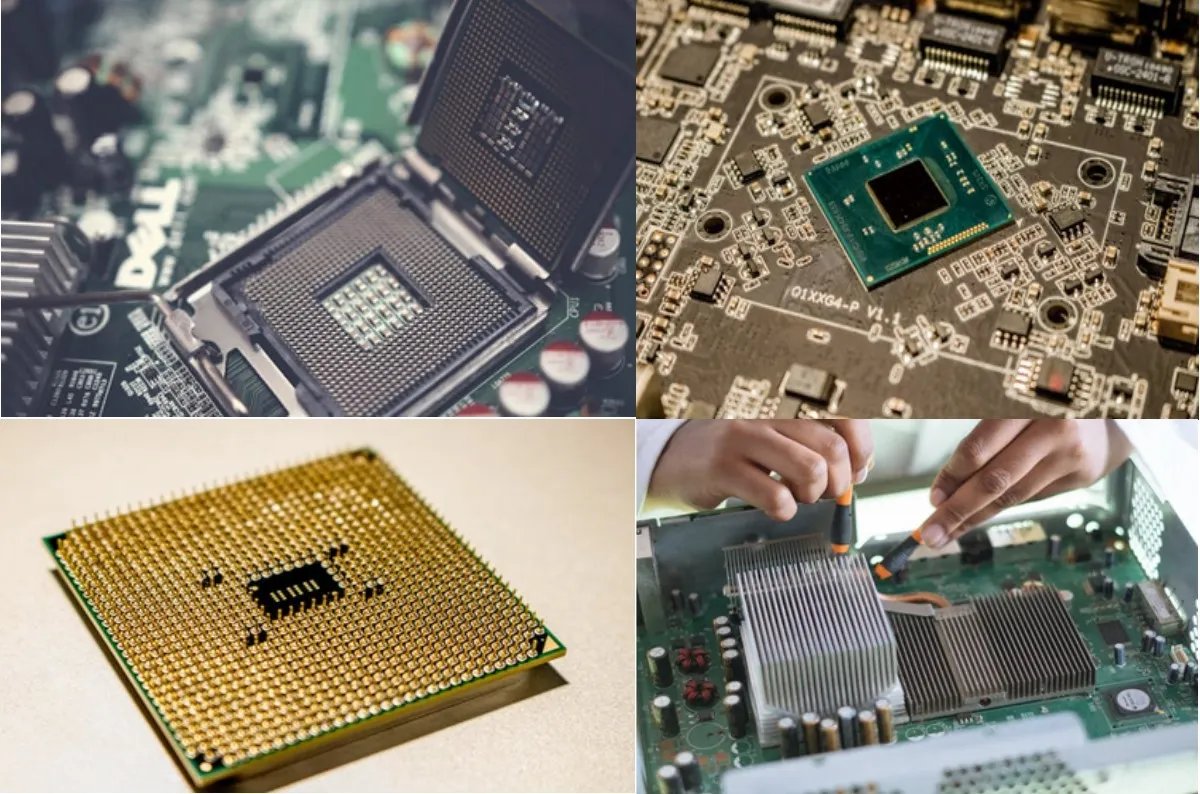

Finding value in the semiconductor industry for an investor is essential to understand the logic behind the surge in the price of semiconductor stocks in India. Let us find the industry dynamics and the best semiconductor stocks in India.

Table of Contents

Semiconductor market in India

India wants to be a semiconductor manufacturing hub for the world. India aims to become one of the top seven semiconductor manufacturers globally by 2030. The Indian semiconductor market size is approximately USD35 Billion in 2023. Indian semiconductor market size is expected to reach USD110 billion which is approximately 10 percent of the global market by 2030.

The government of India provided PLI schemes to promote this industry. The National Electronics Policy or the USD10 billion PLI scheme for semiconductor manufacturing is expected to boost this industry in India.

As part of the policy, the Government of India has extended fiscal support to four projects so far. After Micron’s ATMP facility in Gujarat, two projects by Tata Electronics and another ATMP proposal by India-based CG Power in partnership with Japan-based Renasas got the benefits of this scheme.

The semiconductor manufacturing companies in India are partnering with global players to capture the benefits. Tata Electronics and Taiwan’s Powerchip Semiconductor Manufacturing Corp. (PSMC) are joining hands to build India’s first semiconductor fabrication plant (fab) in Dholera, Gujarat. Tata Semiconductor Assembly and Test Pvt Ltd (TSAT) will also establish a semiconductor unit in Morigaon, Assam.

Let us find out the top 10 Best Semiconductor companies that are expected to get the maximum benefit due to their scale of operation. It is important to conduct a detailed analysis of these top 10 Best Semiconductor stocks in India before investing.

| Articles Related to Nifty Stocks |

| Best Nifty Pharma Stocks List NIFTY Smallcap 250 Best Nifty Midcap 50 stocks to Invest Nifty Midcap 50 stocks list 2024 Best Microcap Stocks Best Smallcap IT Companies |

Best Semiconductor Stocks in India

CG Power

CG is an engineering conglomerate with a diverse product portfolio, solutions, and services catering to Power, Industrial equipment and solutions, and railway. The company is part of the well-recognized Murugappa group of companies.

CG Power partnered with Japan’s Renesas Electronics Corp. and Thailand’s Stars Microelectronics, will set up another semiconductor unit in Sanand, Gujarat. The JV will set up a manufacturing facility with a capacity of up to 15 million units per day. The company started construction for its ₹7,000 crore Outsourced Semiconductor Assembly and Test (OSAT) facility in Gujarat and is expected to commence production by 2027.

This is one of the best companies to invest for the long term.

Kaynes Technology

Kaynes Technology is a leading IoT solutions-enabled integrated electronics manufacturer in India. The company’s services cater to the requirements of Automotive, Industrial, Aerospace and Defence, Outer-space, Nuclear, Medical, Railways, Internet of Things (“IoT”), Information Technology (“IT”), and other industries.

Kaynes Technology through its arm, Kaynes Semicon, is planning to have 13 chip assembly and test lines over the next 2 years with a volume of 1 billion chips annually. The company is planning to invest Rs 2,800 crore in the OSAT facility in Telangana. The company is planning to invest Rs 4,000 crore to develop a semiconductor OSAT/ATMP plant in India.

Also Read

Tata Elxsi (TTEX)

Tata Elxsi supports the semiconductor industry through end-to-end solutions including VLSI design, verification, and software development across sectors. Tata Elxsi collaborated with Arm, the global semiconductor designs and software platform, to offer advanced solutions on the latest Arm processor.

Tata Electronics (Not listed), a TATA group company, started exporting limited quantities of semiconductor chips packaged at its Bengaluru-based research and development centre. The company has started construction on its Rs 91,000 crore semiconductor fabrication facility at the Dholera Special Investment Region (DSIR), Gujarat. TATA Electronics is also planning to invest INR 27,000 crore in a greenfield facility in Assam for the assembly and testing of semiconductor chips.

RIR Power Electronics Limited

RIR is a semiconductor company with a global presence. The company has over five decades of association with International Rectifier, USA, for the manufacturing of power semiconductors.

The market capitalization of RIR is Rs. 1,368 crores with a low debt-to-equity ratio of the company standing at 0.54 making it an attractive investment option.

In Oct 2023, RIR Power Electronics Ltd got the required approval from the Odisha government to invest ₹510.80 crore to set up a fabrication and packaging facility for Silicon Carbide (SiC) devices. The company has strong potential to grow with the growth of the industry in India.

Moschip Technologies Limited

Headquartered in Hyderabad, India, MosChip Technologies is a semiconductor and system design service company. The market cap of the company is Rs. 5,301.02 crores. The share price of Moschip Technologies has already been overvalued. The debt-to-equity ratio of the company stands at 0.26.

The company registered a strong 40 per cent year-over-year growth in revenue from operations, rising from Rs. 53.83 crores in Q4 FY22-23 to Rs. 75.42 crores in Q4 FY23-24. However, the net profit declined by 42.8 per cent, falling from Rs. 1.52 crore to Rs. 0.87 crore over the same period.

ASM Technologies Limited

ASM Technologies is a leading provider of technology engineering services for semiconductor and electronics companies worldwide. ASM is not a direct semiconductor manufacturer but plays a crucial role in the supply chain of this industry.

The company helps to set up fabrication facilities and vital equipment. With its headquarters in India, the company is present in major countries such as the USA, Singapore, UK, Canada, Mexico, and Japan.

The market cap of the company is INR 1,432.3 crores, while the debt-to-equity ratio of the company stands at 0.58. The company reported a 14.2 per cent decline in revenue from operations, falling from Rs. 51.94 crore in Q4 FY22-23 to Rs. 44.6 crore in Q4 FY23-24 (YoY), while the net profit stood at a loss of Rs. 3.4 crore in Q4 FY23-24, falling from Rs. 0.4 crore in Q4 FY22-23.

These are the few best companies to be invested in to capture the growth story of the SEMICONDUCTOR industry in India. Please do your analysis before investing in any stock. A few of these companies are already overvalued hence investing in these stocks might be risky now. Wait for the correction to invest.

There are other related semiconductor stocks in India to consider. Below companies may not directly manufacture semiconductors but rather play a major role in the value chain of the semiconductor industry in India. Do your analysis about these companies before investing.

All Related Semiconductor Stocks in India

| Semiconductor Companies India | Semiconductor Stocks India (NSE/BSE) | Market Cap(Rs. Cr.) | PE Ratio(TTM) | Debt Equity Ratio | RoE(%) | RoC (%) |

| Kaynes Technology India Ltd. | KAYNES | 24873.72 | 135.71 | 0.14 | 16.4 | 22.16 |

| Syrma SGS Technology Ltd. | SYRMA | 8873.93 | 82.68 | 0.23 | 11.71 | 15.41 |

| Insolation Energy Ltd. | 543620 | 6264.49 | 0 | 1.31 | 29.2 | 19.86 |

| DCX Systems Ltd. | DCXINDIA | 4153.04 | 54.8 | 0.9 | 20.95 | 13.13 |

| Avalon Technologies Ltd. | AVALON | 3623.25 | 129.47 | 1.41 | 34.37 | 17.53 |

| Apollo Micro Systems Ltd. | APOLLO | 3362.19 | 108.04 | 0.42 | 5.71 | 10.68 |

| Websol Energy System Ltd. | WEBELSOLAR | 2534.49 | 0 | 0.14 | -12.37 | -12.39 |

| IKIO Lighting Ltd. | IKIO | 2441.68 | 40.31 | 0.81 | 39.87 | 31.74 |

| Centum Electronics Ltd. | CENTUM | 2145 | 0 | 1.26 | 3.24 | 8.31 |

| Swelect Energy Systems Ltd. | SWELECTES | 1899.01 | 31.03 | 0.7 | 3.82 | 4.91 |

| ICE Make Refrigeration Ltd. | ICEMAKE | 1440.45 | 54.87 | 0.04 | 29.18 | 37.94 |

| Vinyas Innovative Technologies Ltd. | VINYAS | 1419.56 | 92.5 | 2.22 | 20.99 | 17.73 |

| RIR Power Electronics Ltd. | 517035 | 1410.27 | 200.64 | 0.97 | 20.19 | 14.97 |

| Aimtron Electronics Ltd. | AIMTRON | 968.64 | 71.22 | 0.65 | 33.44 | 32.81 |

| Australian Premium Solar (India) Ltd. | APS | 916.23 | 148.91 | 0.15 | 26.05 | 32 |

| SPEL Semiconductor Ltd. | 517166 | 815.36 | 0 | 0.51 | -5.65 | -2.36 |

| Kernex Microsystems (India) Ltd. | KERNEX | 734.9 | 0 | 0.13 | -32.07 | -21.64 |

| BPL Ltd. | BPL | 648.98 | 48.4 | 0.1 | 2.52 | 6.16 |

| Modern Insulators Ltd. | 515008 | 557.71 | 15.47 | 0.02 | 7.46 | 7.62 |

| Hindusthan Urban Infrastructure Ltd. | 539984 | 374.48 | 0 | 0.87 | -16.66 | -5.41 |

| CWD Ltd. | 543378 | 265.44 | 234.28 | 0.22 | 10.36 | 13.9 |

| Vintron Informatics Ltd. | 517393 | 255.99 | 0 | -0.84 | 0 | 0 |

| Cosmo Ferrites Ltd. | 523100 | 209.38 | 0 | 2.27 | 7.78 | 9.45 |

| Surana Solar Ltd. | SURANASOL | 194.46 | 0 | 0 | 4.06 | 5.7 |

| Edvenswa Enterprises Ltd. | 517170 | 185.38 | 25.13 | 0 | 18.88 | 20.8 |

| Electro Force (India) Ltd. | EFORCE | 184.98 | 32.16 | 0 | 55.7 | 57.01 |

| Pulz Electronics Ltd. | PULZ | 112.2 | 18.13 | 0.01 | 38.33 | 52.37 |

| BCC Fuba India Ltd. | 517246 | 104.57 | 27.84 | 0.44 | 15.82 | 13.37 |

Please share your comments or write to me to share my analysis on any of the below companies. I can help you by sharing a detailed analysis of the company and my view on these companies. Hope this helps!

List of the prominent Semiconductor companies in India to play a major role in the semiconductor market in India:

Semiconductor Companies in India

- Broadcom India Pvt. Ltd.

- Chiplogic Semiconductor Services Private Limited

- Continental Device India Pvt. Ltd.

- MosChip Technologies Ltd.

- NXP Semiconductors India Private Limited

- E-InfoChips Private Limited

- ASM Technologies Ltd.

- Masamb Electronics Systems Private Limited

- Semi-Conductor Laboratory

- Saankhya Labs Pvt. Ltd.

- ROHM Semiconductor India Pvt. Ltd.

- Infineon Technologies India Pvt. Ltd

- Renesas Electronics India Pvt. Ltd.

- STMicroelectronics Pvt. Ltd.

- Silicon Automation Systems (India) Pvt. Ltd.

- Sand Microelctronics Pvt Ltd.

- Silicon Interfaces

- Smart Modular Tech

Frequently Asked Questions

The size of Semiconductor market in India

The Indian semiconductor market size is approximately USD35 Billion in 2023. Indian semiconductor market size is expected to reach USD110 billion which is approximately 10 percent of the global market by 2030.

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest. Learn all company insights, news analysis, market intelligence with us.

To know more information about company insights for investment, and business overview of companies for investment, here are some suggested readings on company insights for investment – Green Hydrogen Stocks in India, IREDA Share price Target, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price.