Unlisted OLA electric share price analysis

Share With Friends

There are a lot of crazes to know about the 2W electric vehicle maker, OLA electric Share Price. The most visible brand of this company is OLA electric scooter. OLA Electric Mobility Company has not yet been listed on the stock exchanges in India. The company is planning to come with the Initial public offering. OLA Electric IPO date is not yet announced. However, OLA Electric IPO may be open for subscription this year 2024. The market regulator SEBI has already given its node to this IPO.

We will share the updates about the OLA electric IPO details in a separate post. However, let us focus on the company analysis in this article. Let’s dive into the business model of the company, industry growth prospects, and future potential of this company to generate wealth for its shareholders.

Table of Contents

OLA Electric Share Price Unlisted

OLA share is not listed in the exchanges in India and the company is planning to come up with the Initial public offering in 2024. However, the company is trading as an unlisted share on the unlisted company platform. I have reviewed the price of Ola Electric share price unlisted trading at Rs 130 on the Planify platform with a face value of Rs 10 and the market capitalization of this company is Rs25,401 crore.

From FY 2024 till December 2023 the company’s market share in the 2W EV market was 33% which is a rise from 6% in FY22 and 21% in FY23. The company also registered strong revenue growth from Rs 373 Crore in FY22 to Rs 2,631 Crore in FY23 which is huge growth of over 600%.

OLA Electric Share Price Analysis of Strength

Also Read

OLA Electric Credit Rating

ICRA has given a consolidated rating for both Ola Electric Technologies Private Limited (OETPL) and its parent, Ola Electric Mobility Private Limited (OEMPL) and given [ICRA]A (Stable) rating on November 30, 2023. This rating is supported by the strong balance sheet of the company.

Electric Vehicle Market in India

OLA Electric is the leader in the electric 2-wheeler (e2W) industry in India. The e2W market in India is gaining momentum backed by supportive Government policies such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicle, or FAME, scheme, and the Production Linked Incentive, or PLI, scheme.

According to SIAM India produced around 26 million vehicles in FY23 while the production of 2-wheelers in FY23 was 19.5 million. India contributes 15-20% of the world’s total 2W production, the second largest 2W producer in the world after China. The country is exporting approximately 4 million 2-wheelers.

India is also the second largest consumer of 2-Wheerlers in terms of domestic sales volumes. The market size of the Indian 2-wheeler market was ₹1.4-1.6 Tn (US$17-20 Bn) in FY 2023. Two-wheeler sales are reported 15.8 million in FY23.

The consumption of E2W vehicles has grown rapidly to form ~5.1% of 2W registrations in H1 FY 2024, primarily led by scooters. The improving battery technology and greater customer awareness and acceptability will further drive the growth in this industry. The E2W vehicles are expected to be half of the total 2-wheeler sales volumes by FY2028. There are also export opportunities of 100-110 Mn 2W units by FY2028.

OLA Electric Market Share in India

Despite EV two-wheeler sales falling 52 percent to 64,013 units in April 2024, from the preceding month Ola Electric expanded its market share to over 50 percent in April, selling 33,934 electric two-wheelers, according to Vahan website data as of May 1.

OLA Electric Business Model

OLA Electric Mobility was incorporated in January 2021, OETPL was set up to design, manufacture, and sell e2Ws. The company is a leading player in the e2W segment in India. The company is an integrated manufacturing company with set up a state-of-the-art plant in Tamil Nadu, India.

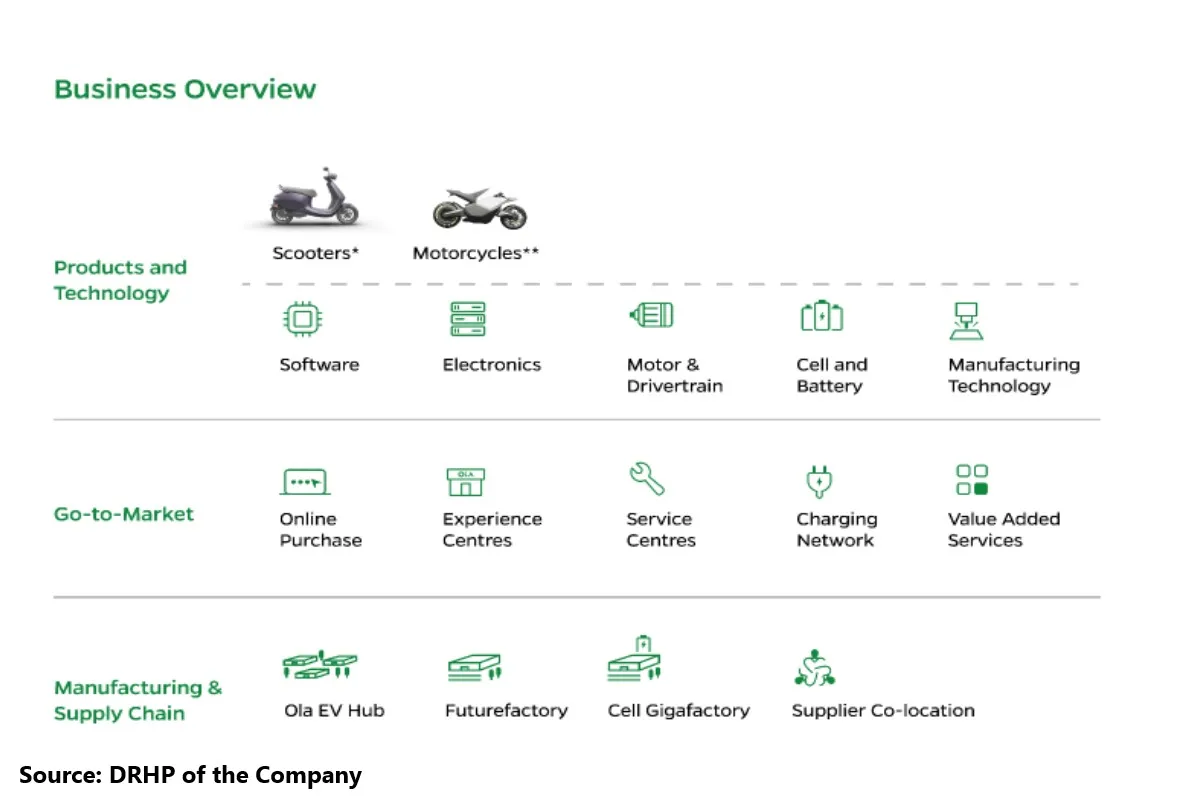

As per the OLA Electric Business Model is concerned, the company is an integrated OEM. The company operates in all the segments of the E2W market such as 2-wheelers, software, electronics, motor and drivetrain, battery, and the required manufacturing technology.

OLA Electric Share Price Target Future Potential

- OLA Electric has substantial capex plans for a battery cell manufacturing unit. The total project cost of ~Rs. 2,730 crores for 5GWH capacity initially, with plans to expand capacity.

- Supportive government policies such as – the Production Linked Incentive (ACC-PLI) scheme – will help the company.

- The company is a vertically integrated company with manufacturing all the required equipment for its e2W business.

- Strong R&D capability in India, the UK, and the US including an innovation center focusing on battery technology.

- Strong distribution channel with a direct-to-customer (D2C) omnichannel distribution network that consists of 935 experience centers and 414 service centers across 24 states in India.

- The company also planning to expand its charging setups across the country. As of October 2023, the company has 224 hyperchargers across 17 states in India and the company aims to add around 900 hyperchargers over FY25 and FY26.

- A strong brand with improved product quality helps the company to occupy over 50% of the market share in the E2W market in India.

- However, the company has high debt. The total debt of the company is Rs1,664 crore in FY23 and the debt-to-equity is 0.4.

- Though the revenue of the company has been increasing over the years from Rs 1,060.81 million in FY21 to Rs 27,826.97 million in FY23, the company is not in profit as of now.

Final Words: OLA Electric Share Price Analysis

The Electric vehicle industry as a whole has been performing well with supportive government policies worldwide. Though the reduction of subsidies in India has put some challenges for the industry, increasing consumer awareness, updated technology, and reduction of the cost of the vehicle will have a positive impact on the industry as a whole.

OLA Electric has been performing very well despite challenges in the industry. The company has been increasing its market share over the years and is gearing up for the launch of new models. There is strong demand for EV 2-wheelers below Rs 1 lakh segment. OLA Electric is ready to capture that segment with the launch of the OLA S1X model.

Considering this, OLA electric share price has a strong potential in the future to grow. OLA Electric IPO may open for public subscription in 2024 which will boost the brand further both in terms of funding as well as branding.

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment – Green Hydrogen Stocks in India, 10 Best IPOs in 2022, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price, Tata Technologies IPO, AI Stocks in India.

Is OLA Electric Share Price listed now?

No, OLA Electric share is not an listed as of now. The company is yet to come up with its initial public offering.

Can you invest in unlisted OLA Electric Share?

Yes, one can invest in unlisted OLA electric share. However, there is higher risk involved in unlisted shares. Do your due diligence before investing in any unlisted share.

What is OLA Electric IPO date?

The draft paper (DRHP) of OLA electric is approved by SEBI. The OLA electric IPO may open for public subscription in 2024.