Orient Technologies IPO review

Share With Friends

ORIENT TECHNOLOGIES IPO Review: Key Facts

Founded in 1997, Orient Technologies is a fast-growing information technology (IT) solutions provider in India.

The company operates in three business verticals – IT Infrastructure, IT Enabled Services (IteS), Cloud and Data Management Services.

Orient Tech operates in across diverse customer industries such as banking, financial services, and insurance (BFSI), IT, IteS, healthcare /pharmaceutical

- The company filed the Draft Red Herring Prospectus (Orient tech DRHP Download) on February 20, 2024.

- The IPO consists of a fresh issue of Rs120 crore and an Offer for Sale of up to 4,600,000 Equity Shares.

- The total value of this IPO: Rs — Crore

- Orient Technologies IPO is opening in: — 2024

- Orient technologies IPO face value: Rs 10

- The Indian ITeS Industry grew by 10% in Fiscal 2023 and is expected to grow by ~8% CAGR from 2023 to 2027.

- The Cloud and Data Management Services industry is expected to grow strong globally.

- Strong growth potential for this business due to strong demand from clients domestically as well as globally.

- I would invest in the company during the IPO process if the valuation of the company is reasonable.

Table of Contents

ORIENT TECHNOLOGIES IPO Details

| Orient Technologies IPO Details | Orient Technologies IPO Details date, Price and other |

| Orient Tech IPO date | |

| Orient Tech IPO Price band | ₹ to ₹ per share |

| IPO date of allotment | |

| Refunds Initiation date | |

| Credit of Shares to Demat Account | |

| Orient Tech IPO date of listing | |

| Total IPO size | ₹ Crore |

| Fresh Issue | ₹ 120 Crore |

| Offer for Sale | 75,000,000 Equity Shares Aggregating up to ₹ -Crore |

| Retail (Min lot size) | 1 lot of – equity shares Total investment ₹- |

| Retail (Max lot size) | – lot of – equity shares Total investment ₹- |

| Retail Allocation | – |

| Orient Tech share price Face Value | ₹ 10 per share |

| Orient Tech share price Listing on | BSE & NSE |

| Equity Shares outstanding prior to the Offer | 35,816,500 Equity Shares |

Now the big question is – do you invest in the Orient Technologies IPO? Let us find out details about the company and why you should consider investing in this company.

Also, read SEBI registered research analyst: is it good to take their stock picks?

Also, read 52-week high stocks with strong momentum

What is ORIENT TECHNOLOGIES LIMITED business model

Founded in 1997, Orient Technologies is the fastest-growing IT provider in India. The company provides IT services in the area of IT Infrastructure including Data Centre Solutions and End-User Computing. The IT-enabled services (ITeS) include Managed Services, Multi-Vendor Support Services, IT Facility Management Services, Network Operations Centre Services, Security Services, Renewals, and Cloud and Data Management Services including migration of workload from data centers to the cloud.

Orient Technologies has over two decades of experience in the industry serving domestic customers in industries such as banking, financial services, and insurance (BFSI), IT, IteS, and healthcare /pharmaceutical.

Let us analyze the Orient Technologies’ financial breakdown

ORIENT TECHNOLOGIES IPO Financials breakdown

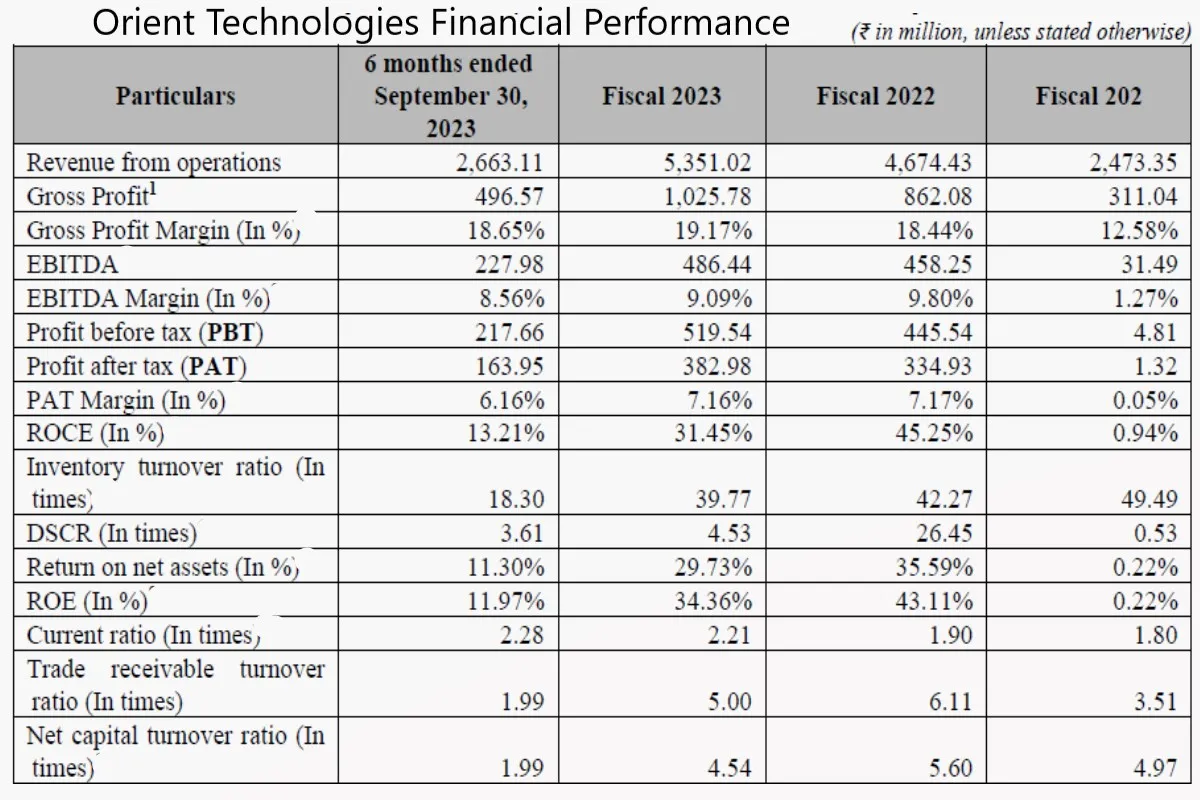

As per the DRHP filed by the company, revenue from operations grew at a CAGR of 47.09% between Fiscal 2021 and Fiscal 2023 while revenue from operations during 6-month period ended September 30, 2023, and during Fiscal 2023, Fiscal 2022, and Fiscal 2021, was ₹ 2,663.11 million, ₹ 5,351.02 million, ₹ 4,674.43 million and ₹ 2,473.35 million, respectively.

The profit after tax (PAT) for 6 months period ended September 30, 2023, and for Fiscal 2023, Fiscal 2022, and Fiscal 2021, was ₹ 163.95 million, ₹ 382.98 million, ₹ 334.93 million and ₹ 1.32 million, respectively.

Also Read

Objective Behind the ORIENT TECHNOLOGIES IPO

- The company will not receive any proceeds from the Offer for sale.

- The company will achieve the benefits of listing the Equity Shares on exchanges.

- This will also enhance the visibility and brand image of the company as well as provide a public market for Equity Shares in India.

- Orient Tech will utilize the net proceeds to acquire office premises at Navi Mumbai and will invest in equipment purchase for setting up of Network Operating Center (NOC) and security operation center at Navi Mumbai.

- The company is also planning to invest in equipment and devices to offer a Devices-as-a-service (DaaS) offering.

Indian IT Industry Outlook

The India IT revenue is estimated to have witnessed a year-on-year growth of 10% in fiscal 2023 driven by government initiatives. In Fiscal 2024, domestic spending is expected to be more focused on products with mass personalization such as data analytics, Machine Learning, and Artificial Intelligence. Investment in technology and platform upgrades along with government focus on e-governance is expected to drive the domestic IT spending to grow at a CAGR of 6.5-7.5% between fiscal 2023 and fiscal 2027.

As of Fiscal 2023, Indian IT Industry’s exports are estimated to account for 25% of the total exports of India. The demand for Indian IT services is expected to grow with the recovery of the USA and European economies from the slowdown. Hence, the IT industry is expected to do well in the coming future both globally as well as domestically.

Orient technologies Competitors

Players in different verticals of the IT industry in India include Dynacons Systems & Solutions, Wipro Limited, HCL Technologies, LTIMindtree Limited, Allied Digital Services Limited, Dev Information Technology Limited, Tech Mahindra Limited, and Silicon Rental Solutions Limited.

Orient Tech IPO GMP

| Bharti Hexacom IPO GMP | IPO Price | GMP | Estimated Listing Price |

|---|---|---|---|

| 27-06-2024 | ₹ | ₹ | ₹ |

| 26-06-2024 | ₹ | ₹ | ₹ |

| ₹ | ₹ | ₹ – |

ORIENT TECH IPO Review: Good or Bad to Invest?

- The company is one of the fastest-growing IT companies in the region.

- The company is mainly focusing on domestic clients and the Indian economy is doing good compared to other countries. Indian IT sector is also expected to do well to meet the domestic demand.

- Small IT players with higher revenue from domestic business are expected to do well compared to the big players.

- Orient Technologies has been reporting revenue growth over the last three years reported.

- Cloud computing and data centers are niche segments in the Indian IT industry and there is huge potential for these segments in India.

- Considering the above factors ORIENT TECHNOLOGIES is a strong company to invest in.

- I would like to invest in its IPO both for long-term investment.

Frequently Asked Questions (FAQs)

What does Orient Technologies do?

Orient Tech is one of the fast-growing IT Solution Provider based in India. The company has experience over the past 2 decades from consulting, recommending, implementing, and providing after-sales services is a rare find. The company operates in three business verticals – IT Infrastructure, IT Enabled Services (IteS), Cloud and Data Management Services.

Who is the CEO of Orient Technologies?

Ajay Baliram Sawant is the Chairman & Managing Director and CEO of the company.

What is the IPO of Orient Technologies?

Orient Technologies plans to raise ₹120 crore by issuing fresh equity shares. Promoters of the company will also sell up to 46 lakh shares. Each promoter intends to sell up to 11.50 lakh shares.

ORIENT TECHNOLOGIES Filed DRHP?

Yes, here is the ORIENT TECHNOLOGIES IPO on February 20, 2024, to float its Initial public offering consisting of both fresh issues and OFS.

Where are Orient Technologies HQ

REGISTERED OFFICE

Off No-502, 5th Floor, Akruti Star, Central Road, MIDC, Opp. Akruti Point Central, Andheri (East), Mumbai – 400 093

Tel: +91 22 4292 8777

www.orientindia.in

Is Orient company good?

Orient Electric is rated 4 out of 5 by employees review on AmbitionBox. It seems the company is good for employees.

What is the revenue of Orient Technologies?

Orient tech revenue from operations increased from ₹467.44 crore in fiscal 2021–22 to ₹535.10 crore in fiscal 2022–23 driven by an increase in revenue from IT and IT infrastructure products and services, Cloud and DMS, and ITES services.

How can I invest in ORIENT TECH IPO?

If you are interested in investing in ORIENT TECHNOLOGIES IPO, you will need to open a demat account and trading account with a broker. You can then apply for shares during the book-building process.

When is the Orient Technologies IPO launch date?

The ORIENT TECHNOLOGIES IPO date has not yet been announced. However, it may be open for subscription in June 2024.

What is the ORIENT TECHNOLOGIES IPO Price?

The ORIENT TECHNOLOGIES IPO Price has not yet been announced

What are the risks of investing in ORIENT TECHNOLOGIES’s IPO?

As with any investment, there are risks associated with investing in ORIENT TECHNOLOGIES’s IPO. These risks include:

1. The price of the shares may fall after the IPO.

2. The company may not perform as well as expected.

3. The company may face regulatory or legal challenges.

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment – Green Hydrogen Stocks in India, 10 Best IPOs in 2022, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price, Tata Technologies IPO.