With the help of KYC registration agency, make the KYC verification process easy with these 4 Best Online KYC Verification steps. Let us find out who are the KYC registration agency, are they registered with SEBI and how can you complete KYC registration online easily.

Share With Friends

Table of Contents

In a digital world today, where almost all transactions occur at the click of a button and personal data flows through networks, it is important to ensure data security. Know Your Customer (KYC) protocols are such an important step in this direction that act like a protector of your data and at the same time help you achieve your digital goal.

Let us find out what exactly is KYC, and how KYC registration agencies help us in navigating this crucial process online.

Also Read

KYC Registration Means

The full name of KYC is Know Your Customers. It is a set of verification processes that businesses and financial institutions use to verify the identities of their customers. This process involves gathering relevant information about their customers, such as government-issued IDs, proof of address, and other identifying documents. These documents help companies to confirm the identity of individuals and assess the risks associated with engaging in business with them.

KYC Registration for Mutual Fund

KYC is most important for both companies such as financial institutions as well as customers like us. It is most important for a business to implement a robust KYC procedure before dealing with clients. A robust KYC process helps companies as below.

- Mitigate Fraud Risk: KYC helps detect and prevent fraudulent activities, such as identity theft and money laundering, safeguarding both businesses and customers.

- Ensure Regulatory Compliance: Many jurisdictions require businesses to adhere to KYC regulations to prevent financial crimes and comply with anti-money laundering (AML) laws.

- Build Trust: By demonstrating a commitment to verifying customer identities and protecting their data, businesses can enhance trust and confidence among their clients.

- Enhance Customer Experience: Along with security from fraud, KYC processes also help streamline customer onboarding, making it a smoother experience for legitimate users.

Role of KYC Registration Agency

It becomes challenging to navigate the complex process of KYC requirements for an individual customer of a small business. A KYC registration agency can help both individual customers as well businesses to easily navigate the KYC process. In today’s digital world, once the KYC process is completed, this can be stored with these KYC agencies for a long time and companies or other businesses can extract the KYC to utilize. These are specialized entities that offer services focusing on the KYC process.

Importance of KYC Registration

- Helps in documentation: KYC registration agencies guide the documentation required for KYC compliance.

- Online Verification Services: KYC agencies offer online verification services, allowing users to submit their documents electronically and complete the verification process remotely.

- Compliance Assurance: With a deep understanding of regulatory requirements, KYC agencies ensure that their clients remain compliant with relevant laws and regulations, reducing the risk of penalties and legal issues.

- Efficiency and Speed: By streamlining the KYC process, KYC Registration agencies help expedite customer onboarding, enabling businesses to onboard clients quickly while maintaining rigorous verification standards.

Benefits of KYC Registration Agency

In India, the Securities and Exchange Board of India (SEBI) mandates the use of SEBI-registered KRAs for KYC verification in the securities market. These KRAs act as central repositories for KYC information. Here’s how they benefit you:

- Single KYC, Multiple Benefits: Once you complete your KYC with a KRA, the information is stored securely. You don’t need to repeat the process every time you deal with a SEBI-registered intermediary like a broker or mutual fund company.

- Convenience and Efficiency: KYC registration with a KRA can often be done online, saving you time and effort.

- Standardized Process: KRAs ensure a uniform KYC process across different financial institutions.

List of KYC Registration Agency SEBI

Here are some of the SEBI-registered KYC registration agency KRA in India:

| KYC Registration Agency SEBI | Registration No. | Online Verification Link |

|---|---|---|

| CDSL Ventures Limited (CVL) | IN/KRA/001/2011 | KYC registration online |

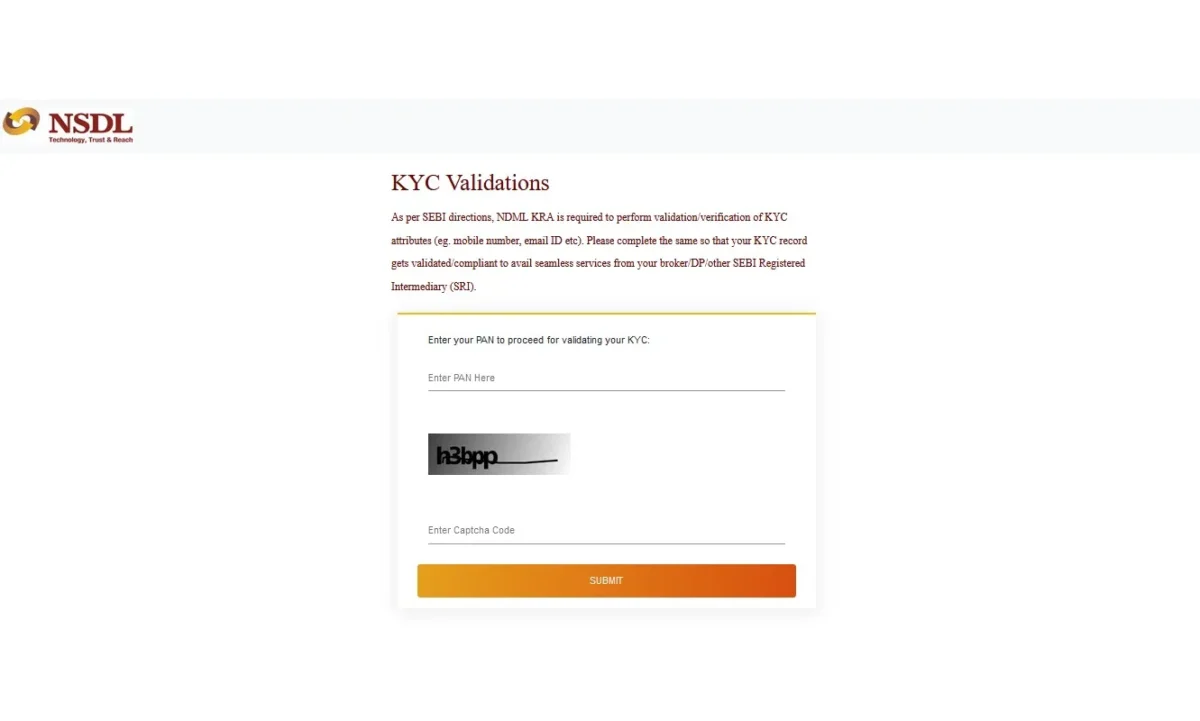

| NSDL Database Management Limited (NDML) | IN/KRA/002/2012 | KYC registration online |

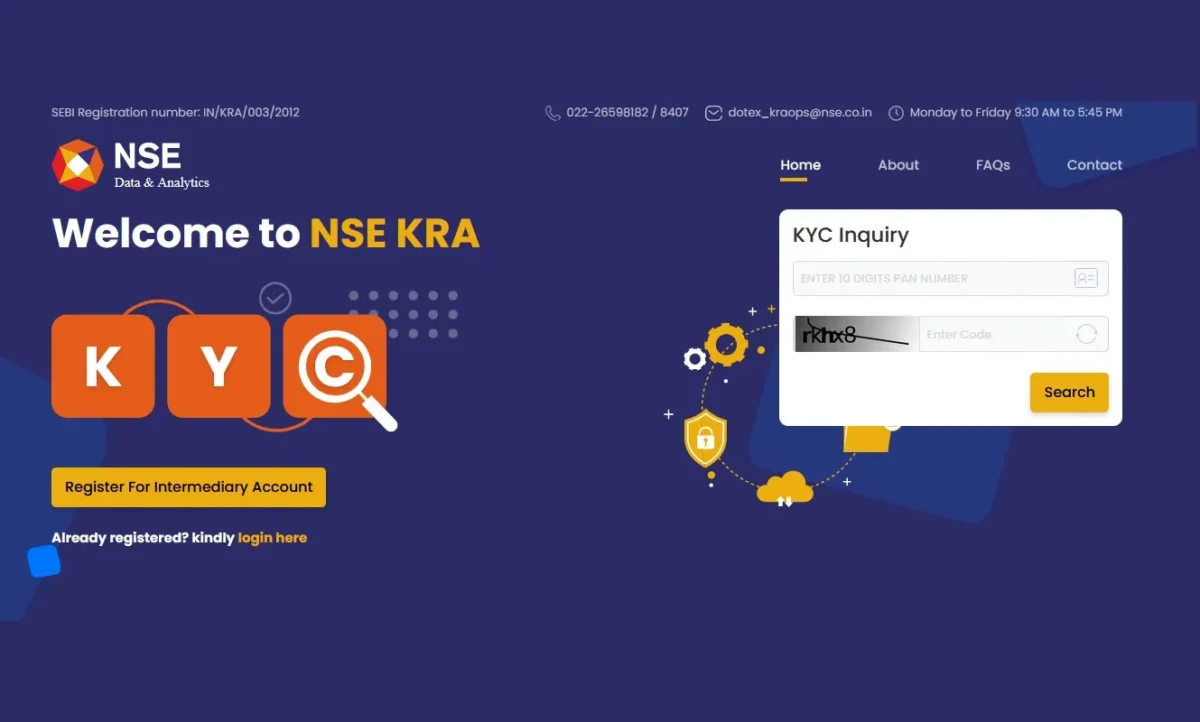

| NSE DATA & ANALAYTICS LIMITED | IN/KRA/003/2012 | KYC registration online |

| CAMS Investor Services Private Limited. | IN/KRA/004/2012 | KYC registration online |

| Karvy Data Management Services Limited | IN/KRA/005/2012 | KYC registration online |

How to Complete Your KYC registration Online

Completing the KYC process online varies depending on the KRA you choose. However, it generally involves 4 steps as below:

- Visiting the KRA’s website.

- Registering for an account.

- Providing your personal information and uploading scanned copies of your identity and address proofs.

- Verify your information through a one-time password (OTP) or other verification method.

Once your KYC is verified by the KRA, you can use that information to invest or get financial services with SEBI-registered intermediaries.

Final words on KYC registration Agency

KYC registration agencies play a crucial role in simplifying and expediting the KYC process, offering a range of services to ensure compliance, enhance security, and build trust in the digital ecosystem. As the digital landscape continues to evolve, partnering with a reputable KYC registration agency can be instrumental in navigating the complex process of identity verification and regulatory compliance.

Frequently Asked Question

How many KYC Registration agency in India?

There are 5 SEBI registered KYC registration agencies are there in India.

How to complete KYC Online in India

KYC online is possible through the online platform of the KYC registration agency such as CDSL, NSDL etc. Please find the online links in the article to complete the KYC process online.

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market in 2023. To know more information about company insights for investment, and business overview of companies to invest, here are some suggested readings on company insights for investment – Green Hydrogen Companies in India, Green Hydrogen Stocks in India, 10 Best IPOs in 2022, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price, Tata Technologies IPO.PREVIOUS POSTINDEGENE IPO Good or Bad to Invest?