Best Momentum Stocks to buy today for 15 – 20% profit

Entering into the stock market by simply opening a demat account with a broker is easy, but investing in the market with success is very difficult. In a bull market, it may be easy to get a few stocks to gain profit as most of the stock runs, but in a bear market or a sideways market, it is difficult to get a stock to invest and gain. Hence it is essential to understand the momentum of the market as a whole and particularly the inherent momentum of that stock you want to invest.

Again, it is also important to identify the best Momentum Stocks to buy today for 15 – 20% profit in a quick run is difficult to get. In this article, I am putting my thoughts on how I identify stocks that are in momentum and what are they. I tried to put these stocks every week on each Sunday.

Also Read

Disclaimer: I am not a SEBI registered Research Analyst. The names of the momentum stocks I am putting here are not recommendations. I am putting the names of the stocks with the analysis for my own record and further analysis. This may help you to get an idea but before investing in any of these momentum stocks you should do research of your own or take the help of a financial advisor or SEBI Registered Investment advisor.

Table of Contents

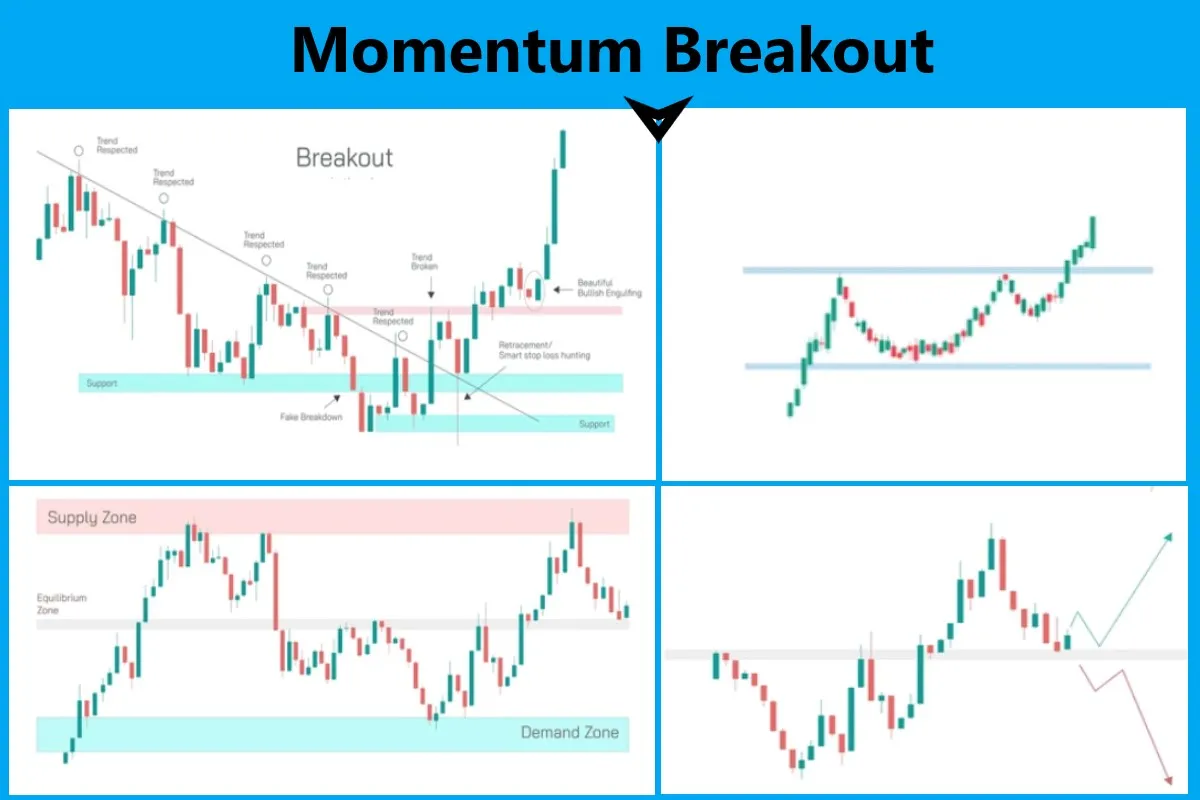

What are momentum stocks?

Momentum stocks are those that are consistently moving upward in their price action over a certain period. The logic behind this strategy is the stocks that have performed well in the past are likely to continue their winning streak shortly. This strategy is just opposite of the traditional value investing, where investors seek undervalued stocks with the anticipation that their true value will be recognized over time.

The principle behind the momentum investing strategy is that once a stock starts moving in a particular direction, it tends to maintain that direction for some time until a force stops it. This is attributed to factors such as market sentiment, positive news, or strong financial performance. Traders and investors leverage this momentum to ride the stock to maximize their profit.

Best Momentum Stocks to buy today for 15 – 20% profit

Breakout Stocks to Watch

HEG

| Stock Name | Price Level | Date Identified |

|---|---|---|

| HEG Share Price | 1720 | 04-03-2024 |

- HEG has been consolidating from April 2019 in range of 1600 to 1900 level

- Quaterly sales is almost same over the year from December 2022 to 2023

- If you look at annual net sales, the company has reported a strong growth in Rs 2149 in March 2020 to Rs 2467 in March 2023.

- PAT grew over three years of period from Rs 53 March 2020 to Rs 532 in March 2023. This is a strong growth.

- Technically, the stock is likely to breakout after a long consolidation due to strong tail wind of sector growth.

- The stock is available at 16.9 PE while the EPS is 98. Industry PE is 20.1.

- The book value of the HEG is 1,136.4

- For me HEG share price target 2024 would be Rs 2200 and if it break that level the HEG share price target 2025 may touch its all time high over Rs 4000 level. The stock may reach all time high late 2024 or early 2025.

Zuari Indusgtries (ZUARIIND)

| Stock Name | Price Level | Date Identified |

|---|---|---|

| Zuari Industries Share Price | 324 | 23-02-2024 |

- Zuari Ind Share price is trading at 325 level after a long term term breakout of the year 2017.

- The stock has formed a cup and handle pattern in weekly chart and consolidating at this level.

- Looking at the PE of the stock, Zuari Industries share is trading at 1.3 PE while the Industry PE is 67. Mean the company is available at very cheap rate

- Net Sales and PAT has increased over the years

- FII has increased their holdings from 1.36% in September 2023 to 1.49% in December 2023

- It may be a good buy at this level

Natco Pharma is in Momentum

| Stock Name | Price Level | Date Identified |

|---|---|---|

| Natco Pharma Share Price | 1024 | 22-02-2024 |

- Natco Pharma share price has given a breakout at 940 level and is sustaining the breakout.

- The script will retest its previous swing high that is around 960 level.

- My analysis says this may be the right time to buy the stock for long term.

- If it bounce back from the previous high of around 950 or 960 level it will go long strongly.

- Fundamentally, the company has given strong quarterly revenue. Natco Pharma revenue jumped 55% as against previous year same period to ₹795.60Cr in the Q3 2023-2024.

- The net profit of the company jumped 241.41% since last year same period to ₹212.70Cr in the Q3 2023-2024.

- If you look at the PE of the company, it seems quite cheap in comparison to industry PE. Natco Pharma PE is 14.37 while industry PE is 41.87.

- There is strong tailwind in healthcare sector as global demand for medicine increasing and the sector has just started moving up in Indian stock market.

- Promoters has also given strong comments on future growth plan.

- As per my analysis, I would like to invest in the stock. at around 950-960 level or once the green candle formed after the current correction.

Aries Agro

| Stock Name | Price Level | Date Identified |

|---|---|---|

| ARIES AGRO Share Price | 275 | 16-02-2024 |

- Best momentum stocks to buy today for 15 – 20 profit.

- Daily, Weekly, and Monthly RSI is above 60.

- Relative strength is above Zero and is in bullish trend

- The sector is in momentum due to government focus on agriculture and benefits to farmers.

- Fundamentally, the company is strong with revenue and operating margin going up.

- Technically the Aries Agro share price has given a breakout at 250 level with strong volume. The stock then retrace to the support level and going up again.

- If Aries Agro Share price move up 318 above, the bullish movement in the stock will continue.

- Keep an eye on the stock.

UNO MINDA – Breakout Stocks to Watch

| Stock Name | Price Level | Date Identified |

|---|---|---|

| UNO MINDA | 707 | 08-01-2024 |

- Auto Ancillary company – Produces alloy wheels, Switches, Off Board Charger, etc.

- Player in Electric Vehicle (2 Wheeler and 3 Wheeler Segment)

- Sector is in momentum

- RSI>60 in all time frame

- Clear and Confirmed breakout after 2 years.

ELECON Engineering – Breakout Stocks to Watch

| Stock Name | Price Level | Date Identified |

|---|---|---|

| ELECON | 1000 | 08-01-2024 |

ENGINERSIN – Engineers India – Breakout Stocks to Watch

| Stock Name | Price Level | Date Identified |

|---|---|---|

| ENGINERSIN | 198 | 08-01-2024 |

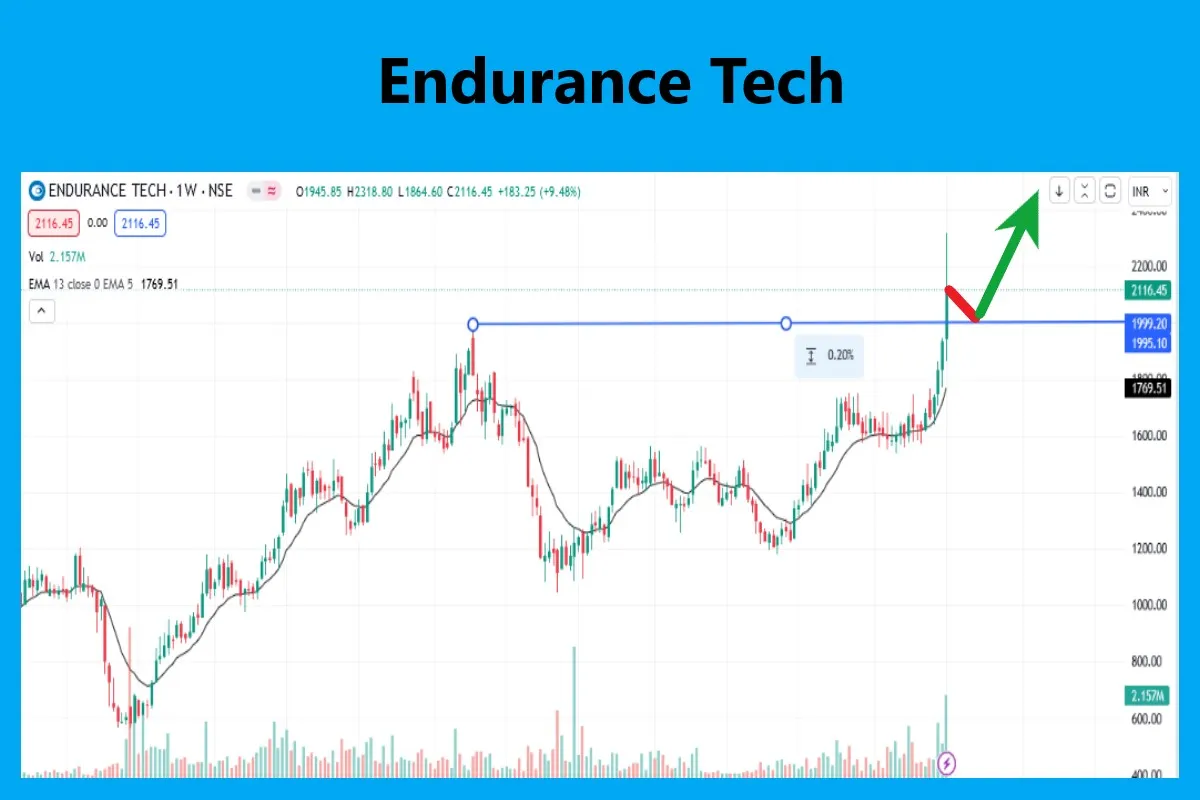

ENDURANCE TECH – Breakout Stocks to Watch

| Stock Name | Date Identified |

|---|---|

| Endurance Tech | 07-01-2024 |

POONAWALLA FINCORP – Best Momentum Stocks to buy now

| Stock Name | Date Identified |

|---|---|

| POONAWALLA FINCORP LTD. | 07-01-2024 |

My Journey with Momentum Stocks

In my personal experience with momentum stocks, I’ve witnessed the excitement and rewards of identifying and investing in stocks with strong upward momentum. I used to see the sectors that are performing well in the market now and try to find the strong technofunda stocks to get into. Specifically, these stocks are running buses that I used to board and it may give 15 – 50% in a couple of months.

However, it is important to note that, it is not always I get the profit, not always the stock started running up after I entered. It takes time for some stocks to start moving up and some started moving immediately.

For example, recently I noticed the automotive sector is moving up and I tried to identify a few stocks that are at the breakout level. Such stocks are Unominda, Endurance, etc. Here I am putting a few best momentum stocks to buy today for 15 – 20% profit.

I used to exit the stock after getting the desired profit or if the stock closed below 26EMA whichever comes first.

How I Identify Momentum Stocks

I used to follow simple methods or indicators as below to identify the best momentum stocks to buy now.

- Relative Strength Index (RSI): This defines a stock’s price movement over a given period, highlighting if the stock is in momentum or not. I used to enter the stock when the Daily RSI crossed over 60 and weekly and Monthly RSI was above 60. That clearly says that the stock is in momentum.

- Moving Average Convergence Divergence (MACD): This indicator reveals the relationship between two moving averages, signaling potential trend continuations or reversals. If the MACD line is over the MACD signal I used to enter into the stock only after the stock satisfies the first step.

- I also check the ADX line if it is above 25. It is better if ADX is between 25 to 50. Again, please check if the latest ADX DI Positive (14) > the latest ADX DI Negative (14).

Word of Caution on the best momentum stocks to buy now

While the above analysis is based on technical indicators to identify the best momentum stocks to buy today for 15 – 20% profit, it is also important to understand the fundamentals of the company. In case after you invest in the company, the broader market turns the opposite, the stock might not perform as desired. In that case, if the fundamentals of the company are strong, then you will not lose your money.

For example, I used to review the company products – whether it is sustainable products or not. Check the sector that the company belongs to and understand if the sector will perform well in the future. The most important parameter is FII and DII investment over the last two quarters. If the FII and DII or promoters’ shareholding increased over the last quarter or so, it is a good company to invest in and worth taking risks.

Apart from the above, I just keep a watch on data for the last 5 years about the company’s earnings, Sales growth, PAT, Interest paid, and cash flow. As a momentum investor, it is advisable to keep an eye on the news related to the broader market, and sector performance always.

Please share your thoughts on my experience and share your experience in the comment box. I will keep putting the best momentum stocks to buy today for 15 – 20% profit. Just keep watching the updates of this post or hit the bell icon to subscribe to this post. It will reach you with the new “best momentum stocks to buy now” each Sunday on your mobile.

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment –10 Best IPOs in 2022, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price, Tata Technologies IPO.

mind2markets is in news

Feedstop has mentioned mind2markets website as one of the best site to provide stock analysis and insights about the company to invest in. Keep in touch.

[…] Best Momentum Stocks to buy today […]

[…] Best Momentum Stocks to buy today […]